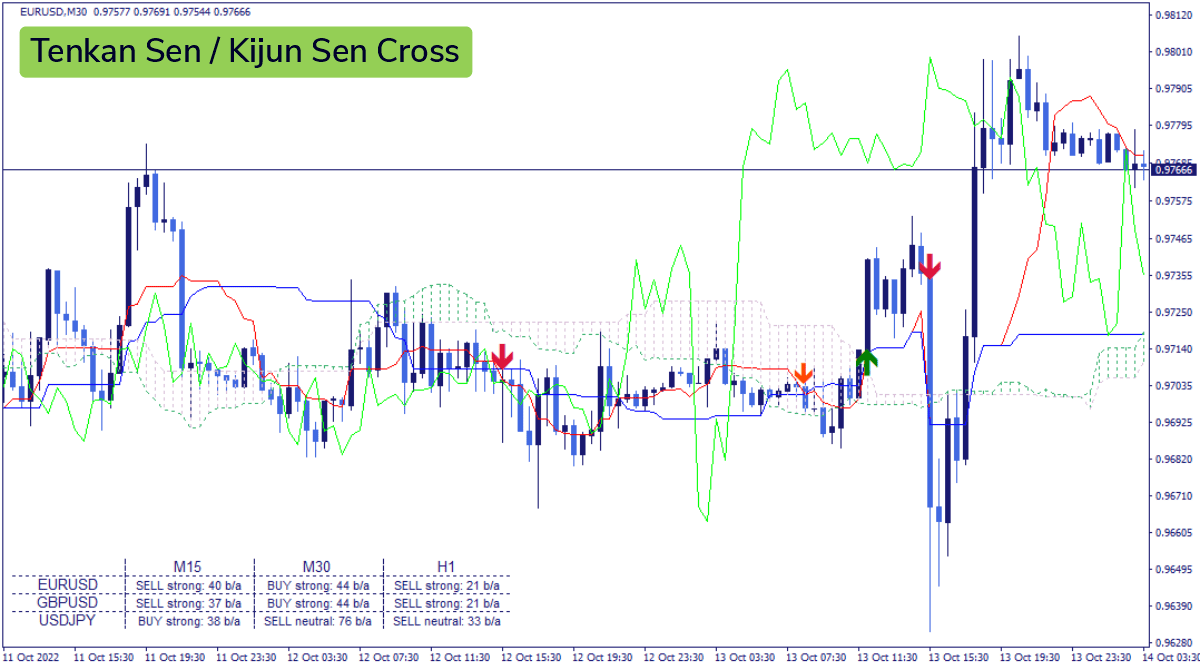

MT4 Ichimoku Indicator (Scanner)

📈 Unlock the power of Ichimoku! In this insightful video, we delve into the significance of Tenkan and Kijun in the Ichimoku Kinko Hyo system, demystifying.

Tenkan Kijun Senkou Span Trading system

The Kijun Line is typically used in conjunction with the Conversion Line (Tenkan-sen) to generate trade signals when they cross. These signals can be further filtered via the other components.

Trading the Tenkan Kijun Cross 2nd Skies Forex

The Kijun-sen is nearly always used alongside the Tenkan-sen (conversion line) to help gauge direction changes in price and to generate trade signals. Tenkan-sen is the 9-period price.

2. APF Tenkan Sen Kijun Sen YouTube

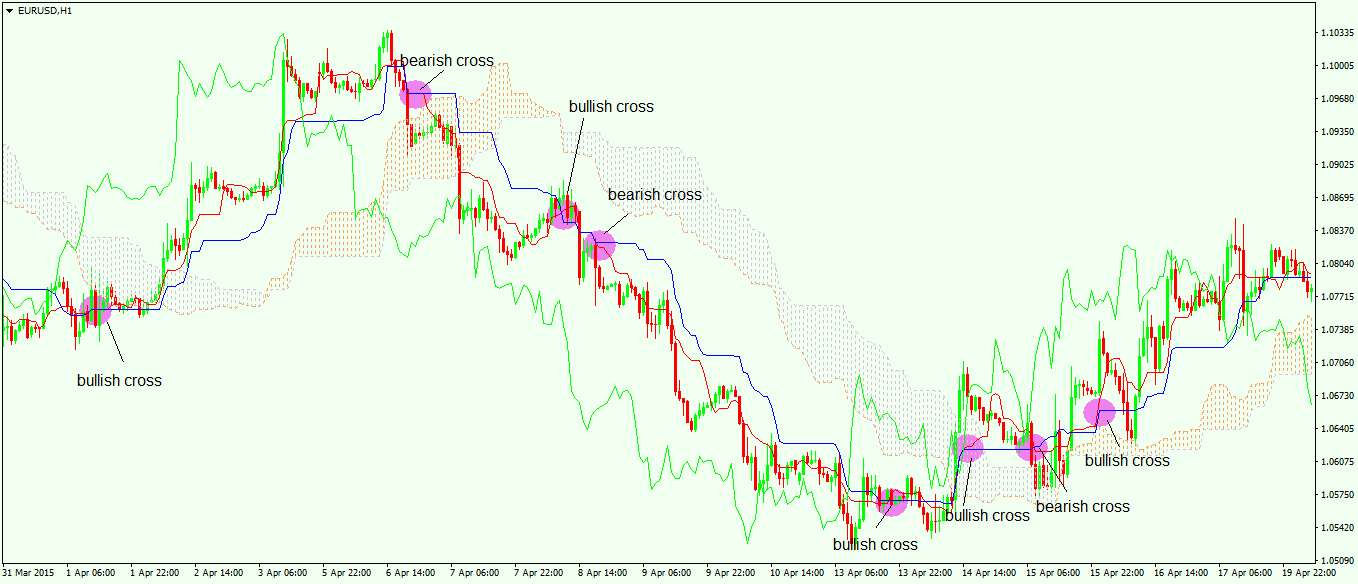

The relationship between Tenkan-sen and Kijun-sen is one of the main aspects of Ichimoku Cloud. Tenkan-sen is an average that is based on fewer time periods than Kijun-sen's, thus responding to price changes faster. Therefore, traders should watch when Tenkan-sen moves above or below Kijun-sen as this is a signal for an uptrend or a downtrend.

MACD Kijun Tenkan Forex Day Trading Strategy The Ultimate Guide To

# Ichimoku cloud scan input nTe = 9; # Tenkan length input nKi = 26; # Kijun length input nSp = 52; # SpanB length def Tenkan = (Highest (high, nTe) + Lowest (low, nTe)) / 2; def Kijun = (Highest (high, nKi) + Lowest (low, nKi)) / 2; def SpanA = (Tenkan [nKi] + Kijun [nKi]) / 2; def SpanB = (Highest (high [nKi], nSp) + Lowest (low [nKi], nSp)).

Ichimoku Cloud Trading Strategy Trading The Tenkan Kijun

The Tenkan-Kijun Cross is the most common Ichimoku system trading signal. The backtest of standalone bullish crosses showed generally favorable results for the period April 2010 through November 2022.

ichimoku cloud binary options strategy Withrow Reld1995

The Tenkan-Kijun Cross Trading Strategy is g. A robust Ichimoku Trading Strategy relies on the different components of the indicator being correctly combined.

KijunTenkan Cross & Forex Ultimate Guide & Explanation for FX Traders

Tenkan-Sen, or Conversion Line, is the mid-point of the highest and lowest prices of an asset over the last nine periods. The Tenkan-Sen is part of a larger indicator called the Ichimoku Kinko.

:max_bytes(150000):strip_icc()/Kijun-Sen-3b696ff097264a429b780a98afeb5cbe.png)

Kijun Line (Base Line) Definition and Tactics

The Kijun-Sen is similar to the Tenkan-Sen but uses a more extended look-back period of 26 periods. It serves as a medium-term trend indicator and is often used as a support or resistance level. Senkou Span A (Leading Span A): (Tenkan-Sen + Kijun-Sen) / 2, plotted 26 periods ahead. Senkou Span A represents the average of the Tenkan-Sen and.

Tenkansen! Kijunsen! HODL the LINE! for BNCBLX by BTCilyKandinsky

The Tenkan-Kijun cross (also known as the TK cross) strategy is best traded on higher time frame charts, as the signals generated on these charts produce more pips. Furthermore, the trend is better represented on higher order charts such as the daily charts.

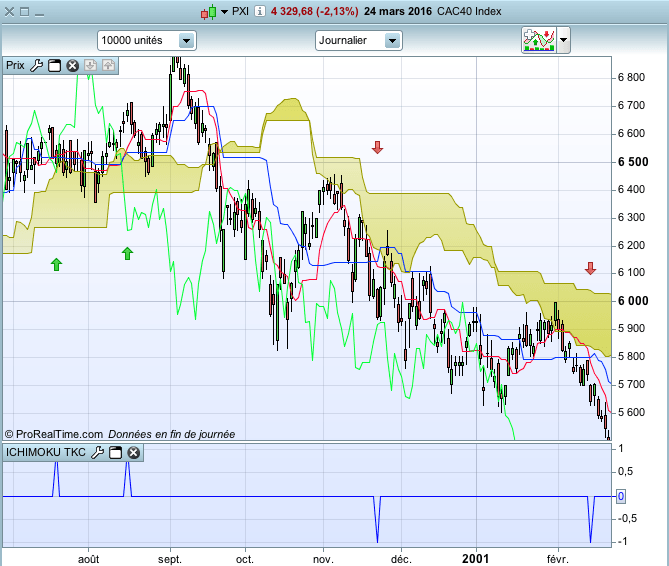

Ichimoku TenkanKijun Cross Indicators ProRealTime trading

The Tenkan-Kijun Cross Explained The Tenkan-Kijun Cross Directional Trading With Ichi Moku Ichi Moku, or Ichi Moku Hiyo Kinko, is an indicator created by a journalist in the 1960's to help simplify market analysis. At first glance the Ichi Moku clouds are quite intimidating and hard to understand.

Kijun Tenkan Indicator • Best MT4 Indicators [MQ4 & EX4] • TopTrading

The most common usage of the Tenkan and Kijun are the 'cross' or what we call the TKx ( Tenkan-Kijun Cross ). Similar to how a MACD uses a cross of its two lines, the Ichimoku Cloud does the same. It is interesting to note that the Ichimoku uses the same periods as the MACD, however it was created over a decade earlier.

Apply Ichimoku Charting To Your Trading February 2013

The Tenkan and Kijun Sens lines are used as a moving average crossover signaling a change in trend and a trade entry point. The Ichimoku cloud represents current and historical price action.

Tenkan sen Kijun sen cross for by tradingichimoku

The Tenkan line represents the arithmetic mean of the highest High and the lowest Low over a specified time period (9 bars by default). The Kijun line is calculated similarly using the 26 bars period by default. The Chikou line represents the current Close price plot projected 26 bars back by default.

ICHIMOKU EXPLAINED PART 2 TENKAN SEN/KIJUN SEN CROSS for FXUSOIL by

Released to the public by Japanese business journalist Goichi Hosoda in the late 1960s, Ichimoku (loosely meaning a "one look" or "one glance") is a technical analysis tool with multiple indicators that may show whether a security is heading in a bullish or bearish direction.

A beginner's guide to trading and investing Ichimoku Cloud (Kumo) charting

An understanding of the Ichimoku calculations for the Tenkan-Sen and Kijun-Sen lines will help to apply the indicator more successfully in systematic trading.